rm(list=ls())Tutorial 9: Scatter Plots and Cleveland Dot Plots

This week we are learning about two types of charts you can create with geom_point(): scatter plots and Cleveland dot plots, also known as lollipop charts.1

Scatter plots are very useful for seeing the relationship between two variables. They are ideal for initial exploratory data analysis. They are usually not the best – without substantial editing – for final data presentation to a non-technical audience.

Cleveland dot plots are a way of summarizing data from a scatter plot. To arrive at data suitable for a Cleveland dot plot, we will revisit some techniques we’ve learned in previous classes: summarize() and pivot_longer(), along with group_by().

A. Clear environment and load packages

I mentioned in an early tutorial, and I mention again here that it sometimes is helpful to get rid of everything in your R environment – all the past dataframes and plots and commands. This is particularly useful when you’ve made a lot of dataframes and your memory is getting clogged, or when you’ve made some odd error and want to start fresh. To clear the R environment, type the below. I usually put it at the beginning of my R programs to be sure that I am working on the most recently loaded dataframe.

Let’s also load packages. This tutorial has no new packages.

library(tidyverse)

library(scales)B. Load and check out data

For this class we’re using new data: property tax records from Arlington County.

B.1. Load data

In principle, you used to be able to find the Arlington data here. You’d use the download button at the bottom left to download the data as a .csv. Then load the data using read.csv(). However, this link no longer works, and – see the next paragraph.

A previous year’s TA had a lot of trouble with this file. So we can all use the same dataset, please download it from here. These are vintage 2019 data.

Now read these data using `read.csv’.

arl.p <- read.csv("H:/pppa_data_viz/2019/tutorial_data/lecture11/2019-04-19_arlington_2019_assessment_data.csv")

dim(arl.p)[1] 65791 46I have 65,791 observations (rows) – hopefully you do, too.

B.2. Explore a little bit

Each observation in this data frame is a property in Arlington County, VA. Broadly speaking, this is the information the county collects on each individual property. Counties in the US (in a few cases, other jurisdictions) are in charge of land ownership records and property taxation.

As these data are new to us (and as Arlington doesn’t seem to provide a dictionary – though if you find one, let me know!), let’s explore these data a bit before moving on.

I use str(), names(), table() and summary() to look at values in this dataframe. I encourage you to use these commands to look at variables other than those I’ve listed below.

names(arl.p) [1] "IvwPropertyAssessmentHistoryKey" "ProvalLrsnId"

[3] "RealEstatePropertyCode" "MasterRealEstatePropertyCode"

[5] "ReasPropertyStatusCode" "PropertyClassTypeCode"

[7] "PropertyClassTypeDsc" "PropertyStreetNbrNameText"

[9] "PropertyStreetNbr" "PropertyStreetNbrSuffixCode"

[11] "PropertyStreetDirectionPrefixCode" "PropertyStreetName"

[13] "PropertyStreetTypeCode" "PropertyStreetDirectionSuffixCode"

[15] "PropertyUnitNbr" "PropertyCityName"

[17] "PropertyZipCode" "ZoningDescListText"

[19] "TradeName" "PropertyYearBuilt"

[21] "GrossFloorAreaSquareFeetQty" "EffectiveAgeYearDate"

[23] "NumberOfUnitsCnt" "StoryHeightCnt"

[25] "ValuationYearDate" "CommercialPropertyTypeDsc"

[27] "CondoModelName" "CondoStyleName"

[29] "FinishedStorageAreaSquareFeetQty" "StorageAreaSquareFeetQty"

[31] "UnitNbr" "PropertyKey"

[33] "ReasPropertyOwnerKey" "ArlingtonStreetKey"

[35] "PropertyExpiredInd" "CommercialInd"

[37] "DistrictNbr" "TaxExemptionTypeDsc"

[39] "CondominiumProjectName" "TaxBalanceAmt"

[41] "AssessedYearDate" "TotalAssessedAmt"

[43] "AssessmentDate" "AssessmentChangeReasonTypeDsc"

[45] "ImprovementValueAmt" "LandValueAmt" str(arl.p)'data.frame': 65791 obs. of 46 variables:

$ IvwPropertyAssessmentHistoryKey : int 74 111 148 185 222 260 334 371 408 445 ...

$ ProvalLrsnId : int 134 136 137 139 140 141 143 144 145 147 ...

$ RealEstatePropertyCode : int 1001007 1001009 1001010 1001012 1001013 1001014 1001016 1001017 1001018 1001020 ...

$ MasterRealEstatePropertyCode : chr "01001007" "01001009" "01001010" "01001012" ...

$ ReasPropertyStatusCode : chr "A" "A" "A" "A" ...

$ PropertyClassTypeCode : int 511 511 511 511 511 511 511 511 511 511 ...

$ PropertyClassTypeDsc : chr "511-Single Family Detached" "511-Single Family Detached" "511-Single Family Detached" "511-Single Family Detached" ...

$ PropertyStreetNbrNameText : chr "3007 N ROCHESTER ST" "6547 WILLIAMSBURG BLVD" "6541 WILLIAMSBURG BLVD" "3518 N SOMERSET ST" ...

$ PropertyStreetNbr : int 3007 6547 6541 3518 3526 3530 3538 3544 3550 3562 ...

$ PropertyStreetNbrSuffixCode : chr "" "" "" "" ...

$ PropertyStreetDirectionPrefixCode: chr "N" "" "" "N" ...

$ PropertyStreetName : chr "ROCHESTER" "WILLIAMSBURG" "WILLIAMSBURG" "SOMERSET" ...

$ PropertyStreetTypeCode : chr "ST" "BLVD" "BLVD" "ST" ...

$ PropertyStreetDirectionSuffixCode: chr "" "" "" "" ...

$ PropertyUnitNbr : chr "" "" "" "" ...

$ PropertyCityName : chr "ARLINGTON" "ARLINGTON" "ARLINGTON" "ARLINGTON" ...

$ PropertyZipCode : int 22213 22213 22213 22213 22213 22213 22213 22213 22213 22213 ...

$ ZoningDescListText : chr "R-10" "R-10" "R-10" "R-10" ...

$ TradeName : chr "" "" "" "" ...

$ PropertyYearBuilt : int 2012 1950 1950 2008 1950 1950 1950 1950 1950 2013 ...

$ GrossFloorAreaSquareFeetQty : int NA NA NA NA NA NA NA NA NA NA ...

$ EffectiveAgeYearDate : int NA NA NA NA NA NA NA NA NA NA ...

$ NumberOfUnitsCnt : int NA NA NA NA NA NA NA NA NA NA ...

$ StoryHeightCnt : int NA NA NA NA NA NA NA NA NA NA ...

$ ValuationYearDate : int NA NA NA NA NA NA NA NA NA NA ...

$ CommercialPropertyTypeDsc : chr "" "" "" "" ...

$ CondoModelName : chr "" "" "" "" ...

$ CondoStyleName : chr "" "" "" "" ...

$ FinishedStorageAreaSquareFeetQty : int NA NA NA NA NA NA NA NA NA NA ...

$ StorageAreaSquareFeetQty : int NA NA NA NA NA NA NA NA NA NA ...

$ UnitNbr : chr "" "" "" "" ...

$ PropertyKey : int 2 3 4 5 6 7 9 10 11 12 ...

$ ReasPropertyOwnerKey : int 20362 55397 57081 26494 36100 40877 11120 37425 17377 619 ...

$ ArlingtonStreetKey : int 179 222 222 185 185 185 185 185 185 185 ...

$ PropertyExpiredInd : chr "False" "False" "False" "False" ...

$ CommercialInd : chr "False" "False" "False" "False" ...

$ DistrictNbr : chr "0G" "0G" "0G" "0G" ...

$ TaxExemptionTypeDsc : chr "" "" "" "" ...

$ CondominiumProjectName : chr "" "" "" "" ...

$ TaxBalanceAmt : num NA NA NA -6749 NA ...

$ AssessedYearDate : int 2019 2019 2019 2019 2019 2019 2019 2019 2019 2019 ...

$ TotalAssessedAmt : int 1941900 1053200 1039500 1406500 760400 1189400 788400 808200 795300 1588800 ...

$ AssessmentDate : chr "1/1/2019 12:00:00 AM" "1/1/2019 12:00:00 AM" "1/1/2019 12:00:00 AM" "1/1/2019 12:00:00 AM" ...

$ AssessmentChangeReasonTypeDsc : chr "01- Annual" "01- Annual" "01- Annual" "01- Annual" ...

$ ImprovementValueAmt : int 1151000 400900 380000 709800 87500 482900 105900 136300 123400 902000 ...

$ LandValueAmt : int 790900 652300 659500 696700 672900 706500 682500 671900 671900 686800 ...table(arl.p$NumberOfUnitsCnt)

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

8 35 1 3 4 5 2 2 10 4 6 8 3 3 5 5

16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32

4 2 8 3 5 5 5 3 1 3 2 2 1 4 3 4

33 34 36 37 38 40 41 42 44 45 46 47 48 49 51 56

4 1 2 4 3 4 5 3 1 1 1 1 2 2 2 1

57 62 63 64 65 66 67 68 70 74 75 77 78 79 81 82

1 1 2 3 1 1 1 1 1 3 2 2 1 1 1 2

83 84 85 87 88 90 91 92 93 94 95 97 99 100 101 102

1 2 1 1 2 3 1 1 3 1 1 1 1 5 1 1

104 105 108 109 110 111 112 114 115 116 119 120 122 125 126 128

2 1 2 3 3 1 1 2 1 2 2 1 1 1 1 3

132 134 135 138 142 143 144 146 147 148 151 152 153 154 155 161

1 4 1 1 1 1 1 1 1 1 1 3 1 1 1 1

162 163 168 170 172 173 178 181 183 184 186 187 188 189 191 193

2 1 1 1 1 1 1 3 2 2 1 1 3 1 1 1

194 197 198 199 200 204 205 208 210 212 214 217 218 219 220 221

1 1 2 1 1 2 2 1 1 2 2 1 2 1 2 2

224 225 227 228 229 231 234 235 237 238 241 244 247 249 250 252

1 1 1 1 1 1 1 1 2 1 1 3 1 3 2 1

253 254 255 257 258 261 262 265 266 267 269 270 272 273 274 280

1 1 1 2 1 2 2 2 1 2 1 1 1 1 1 2

299 300 302 303 308 314 317 318 321 325 326 330 336 337 342 344

2 2 1 1 1 1 1 1 1 2 1 2 1 1 1 1

345 348 350 360 361 363 365 366 369 377 378 383 385 400 406 407

1 1 1 2 1 1 1 2 1 1 2 1 1 1 2 1

410 411 412 435 437 440 442 452 453 454 458 464 474 476 483 491

1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

499 500 504 509 534 539 564 571 575 577 580 597 647 686 699 714

1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

717 834 900 1075 1295

1 1 3 1 1 table(arl.p$PropertyYearBuilt)

0 1000 1742 1750 1832 1836 1840 1845 1848 1850 1860 1862 1865 1866 1867 1870

9 129 1 1 1 2 1 1 1 3 4 1 1 1 1 2

1875 1876 1880 1881 1887 1888 1889 1890 1891 1892 1893 1894 1895 1896 1898 1899

1 1 14 1 1 2 1 6 1 1 1 2 2 2 2 1

1900 1901 1902 1903 1904 1905 1906 1907 1908 1909 1910 1911 1912 1913 1914 1915

117 5 5 1 99 42 6 11 12 21 131 13 19 30 21 90

1916 1917 1918 1919 1920 1921 1922 1923 1924 1925 1926 1927 1928 1929 1930 1931

13 17 37 43 483 37 82 97 270 446 109 93 124 189 444 52

1932 1933 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947

103 80 152 508 354 728 1093 1933 4789 1449 743 208 1764 481 626 1790

1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963

1182 638 2223 1329 1111 731 745 2493 662 370 691 754 637 664 359 268

1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979

644 1643 801 205 154 279 101 103 132 456 580 96 415 128 213 729

1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

697 707 503 1060 546 418 1033 852 242 838 163 271 727 186 350 610

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

352 129 324 173 464 270 378 848 362 2038 1533 915 722 431 321 203

2012 2013 2014 2015 2016 2017 2018 2019

238 365 216 316 277 315 308 4 summary(arl.p$PropertyYearBuilt) Min. 1st Qu. Median Mean 3rd Qu. Max. NA's

0 1944 1956 1963 1987 2019 3392 summary(arl.p$TaxBalanceAmt) Min. 1st Qu. Median Mean 3rd Qu. Max. NA's

-40509.1 -3917.3 -2227.3 -2691.3 -556.8 1797.8 64390 From this I learn that there are many variables in this dataframe, that most structures have few units (from NumberOfUnitsCnt), but a few have quite a few, that the median structure in Arlington was built in 1956 (PropertyYearBuilt), and that most properties are current on their taxes (I take TaxBalanceAmt to be the amount outstanding on property taxes; NA means the property is current).

C. Basic scatters and drawing attention

We now turn to some basic scatter plots to show the relationship between two variables. We’ll rely on geom_point(), which is similar to the ggplot commands we’ve used so far. We then move to two methods for calling out particular areas or conditions of interest.

C.1. Basic scatters

We begin by looking at the correlation between the assessed value of land and the assessed value of the improvements on that land (the structure(s)). The assessed value is the value that the county assessor gives to the property for purposes of taxation. It is distinct from the market value, which is the value for which a property sells on the open market.

Generally, economists anticipate that higher value land should have higher valued structures. We can see whether the data are consistent with this hypothesis using a scatter plot.

We start by simply plotting these two measures, specifying the dataframe and the x (land value) and y (improvement value) amounts.

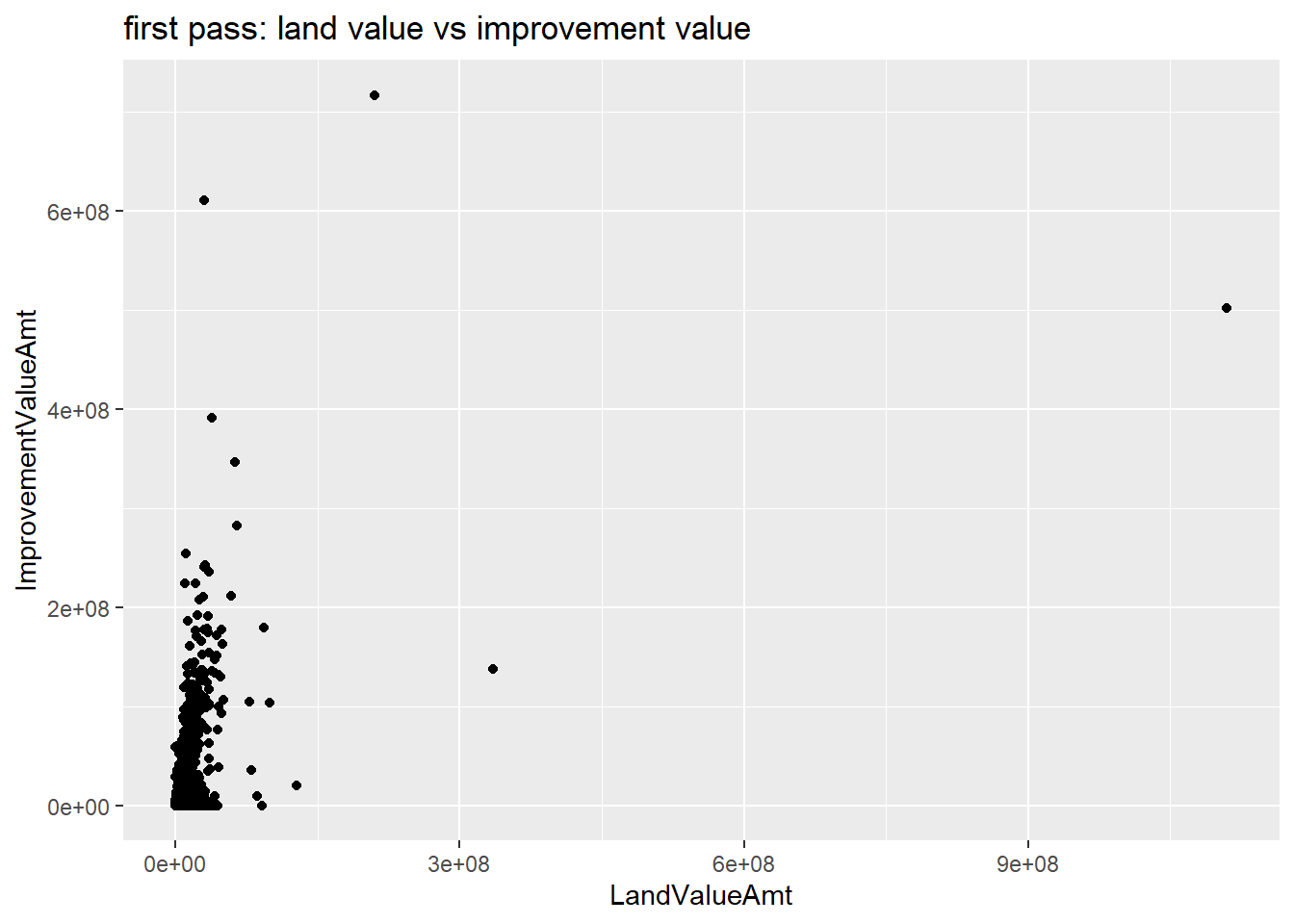

c0 <-

ggplot() +

geom_point(data = arl.p,

mapping = aes(x = LandValueAmt, y = ImprovementValueAmt)) +

labs(title = "first pass: land value vs improvement value")

c0

This plot is illegible! The large values at the high end of the distribution make the part of the distribution where the majority of observations lie invisible. In addition, the numbers on the plot are in scientific notation, which is hard to read. We can fix the problem of outliers in two ways.

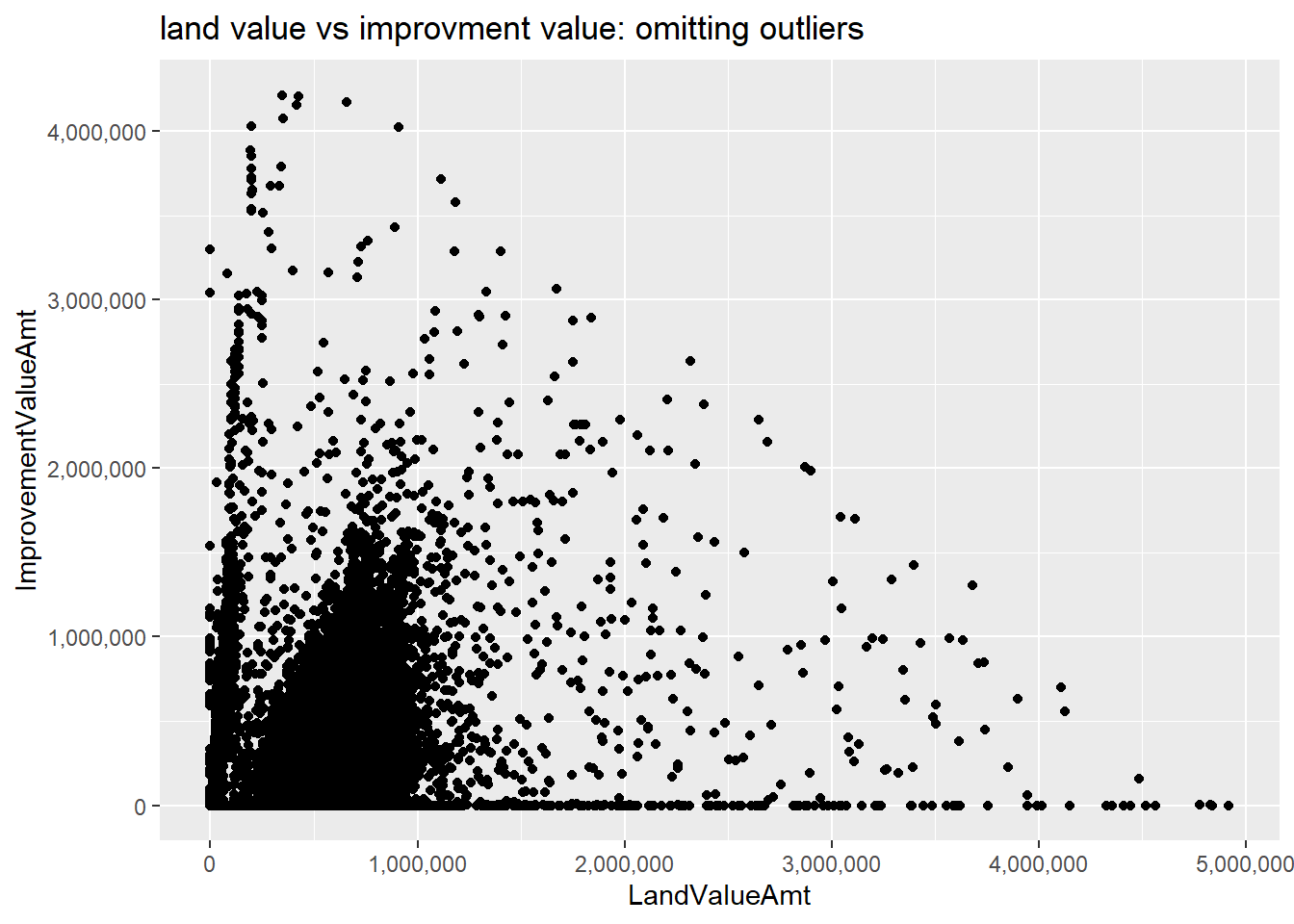

We’ll begin by just omitting the outliers. This isn’t good statistical practice if the outliers are true data, but if we are predominantly concerned about the relationship for most observations (and we’re clear about what we’re doing) this is ok.

You can modify the sample multiple different ways. You can create a new dataframe that is limited by some conditions, and just call that dataframe. You can subset the dataframe directly in the ggplot command, or you can use limits = c(min(xxx), max(xxx)) inside of the scale_x_continuous() command. Here I subset the dataframe inside the ggplot command.

I also return to the commas option we’ve used before in scale_[x or y]_continuous to put commas in the axis numbers. This makes them very easy to interpret.

# (1) omit outliers, add commas

c0 <-

ggplot() +

geom_point(data = arl.p[which(arl.p$TotalAssessedAmt < 5000000),],

mapping = aes(x = LandValueAmt, y = ImprovementValueAmt)) +

scale_x_continuous(label=comma) +

scale_y_continuous(label=comma) +

labs(title = "land value vs improvment value: omitting outliers")

c0

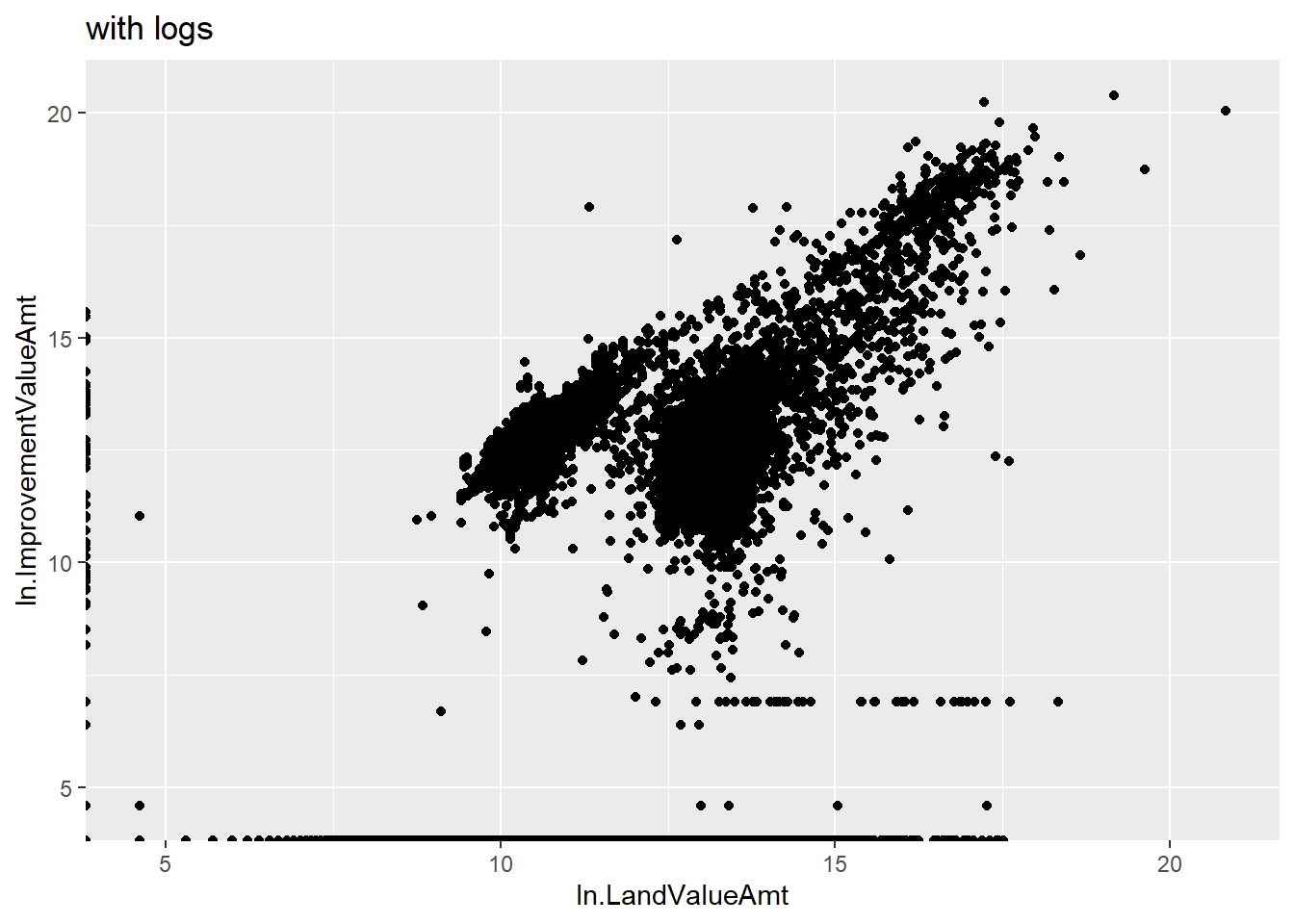

Another way to “squish” a distribution is by taking logs. The log function spreads out the small numbers and relatively shrinks the big numbers. (If this makes no sense, google “graph of log function” and take a look at how the log function transforms data.)

We want to take the log of two variables. You could write a log command twice, but you can also be a more efficient programmer in case you decide to come back and make more logged variables. To program efficiently, don’t use a loop – and in fact, I’m reasonably confident you cannot use a loop for this problem because of difficulties getting R to recognize a variable name made from a loop variable.

Thankfully, there is a quick, elegant solution (that took me over an hour to figure out). Create two new columns based on the log of two existing columns, using paste0 to create the new names.

# (2) take logs

tolog <- c("LandValueAmt","ImprovementValueAmt")

arl.p[paste0("ln.",tolog)] <- log(arl.p[tolog])What this is actually doing is saying

arl.p["ln.LandValueAmt","ln.ImprovementValueAmt"] <-

log(arl.p["LandValueAmt","ImprovementValueAmt"])For large dataframes, this type of processing is also faster than loops.

Now create the logged version of the graph using these new variables (alternatively, you could have logged them in the ggplot command).

cln <-

ggplot() +

geom_point(data = arl.p,

mapping = aes(x = ln.LandValueAmt, y = ln.ImprovementValueAmt)) +

labs(title = "with logs")

cln

This is clearly better than the first one in the sense of seeing all the data. Of course, logged values are also more difficult to understand!

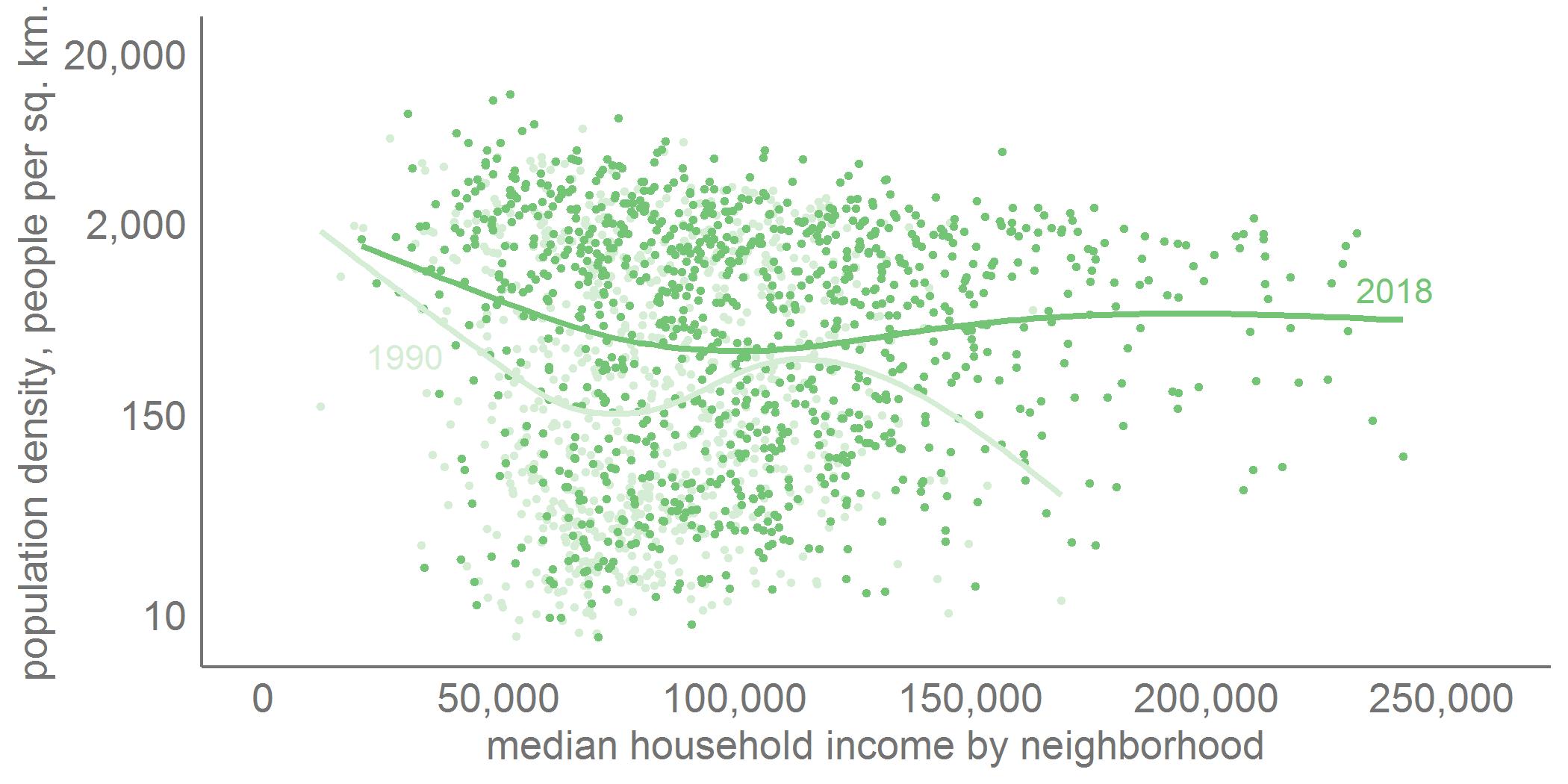

One way to deal with this issue of logged variables is to label the axis of the logged variables with the levels, rather than the logged values. As an example, my graph below, using different data, does this. It shows the relationship between neighborhood population density and neighborhood median income for the exurban jurisdictions of the greater Washington area. The y axis values are logged, but I report the level values, rather than the logged ones. Note that the spacing isn’t exactly equal between the axis numbers (by construction).

C.2. Call out particular areas

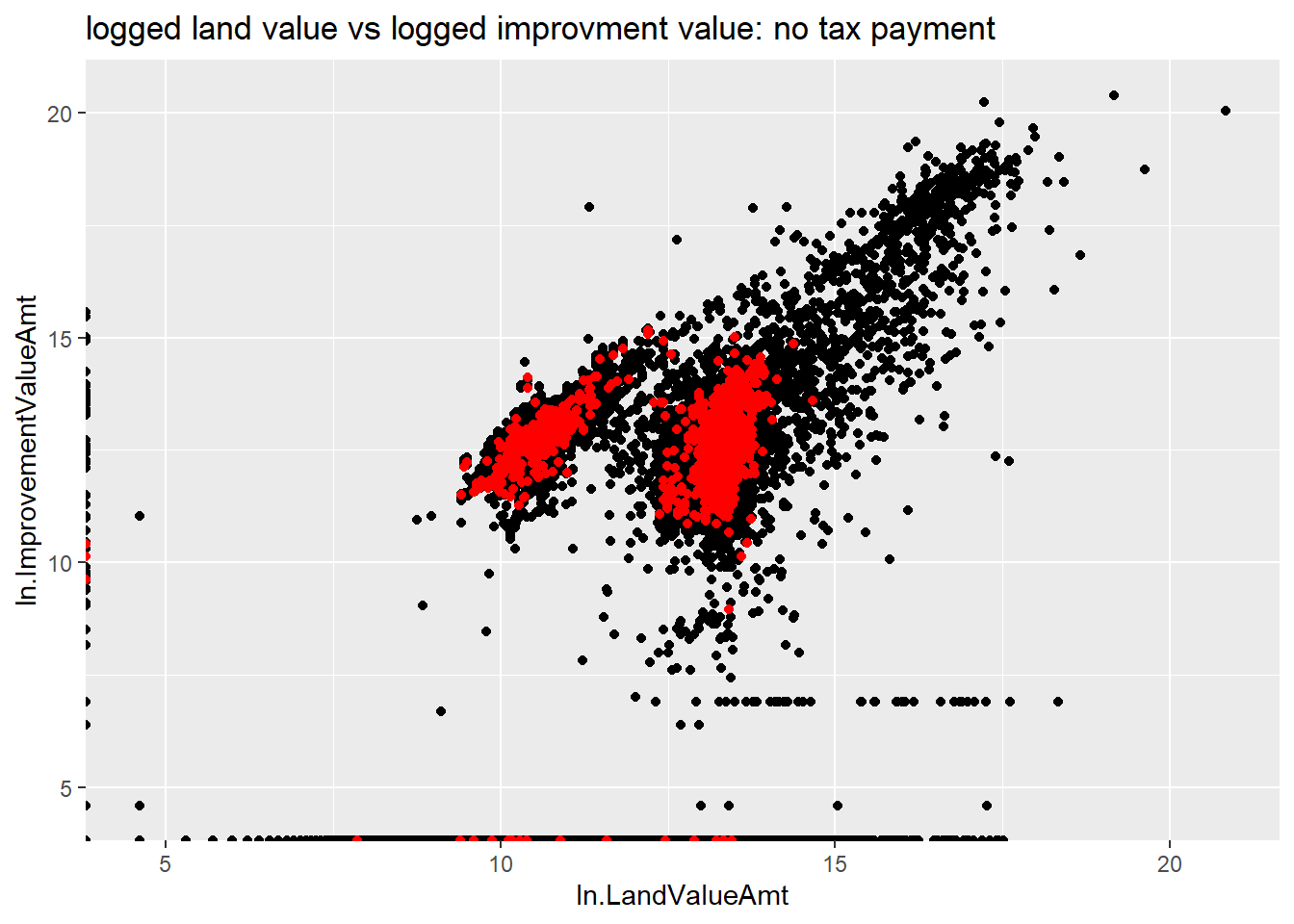

If you’re using a scatterplot for presentation purposes, you’re frequently interested in calling out an area or group. In this section we’ll call out properties with delinquent taxes to see if they systematically differ from properties at large. I’ll continue using the logged values here, since I found that graph easier to intepret.

We begin by making a marker for tax delinquency, using the TaxBalanceAmt variable. Using summary(), I see that NAs are non-delinquent, so I make those 0, and set all others to 1. I check my results with table().

# lets call out those delinquent on their taxes

summary(arl.p$TaxBalanceAmt) Min. 1st Qu. Median Mean 3rd Qu. Max. NA's

-40509.1 -3917.3 -2227.3 -2691.3 -556.8 1797.8 64390 arl.p$tax.late <- ifelse(is.na(arl.p$TaxBalanceAmt) == TRUE,0,1)

table(arl.p$tax.late)

0 1

64390 1401 Now I repeat the previous chart, but with a second layer of red points for the late tax observations. It’s important to put this call second, as R stacks points, beginning with the first layer. If this tax delinquent layer were first, it would be invisible since it would be covered by the following layer. I use color = "red" outside the aes() command to show the delinquent points.

latetax <-

ggplot() +

geom_point(data = arl.p, aes(x = ln.LandValueAmt, y = ln.ImprovementValueAmt)) +

geom_point(data = arl.p[which(arl.p$TotalAssessedAmt < 5000000),],

mapping = aes(x = ln.LandValueAmt, y = ln.ImprovementValueAmt)) +

geom_point(data = arl.p[which(arl.p$TotalAssessedAmt < 5000000 & arl.p$tax.late == 1),],

mapping = aes(x = ln.LandValueAmt, y = ln.ImprovementValueAmt),

color = "red") +

labs(title = "logged land value vs logged improvment value: no tax payment")

latetax

This figure shows that delinquent assessments are much more likely for lower-valued properties. Smaller dots might make this relationship more clear visually.

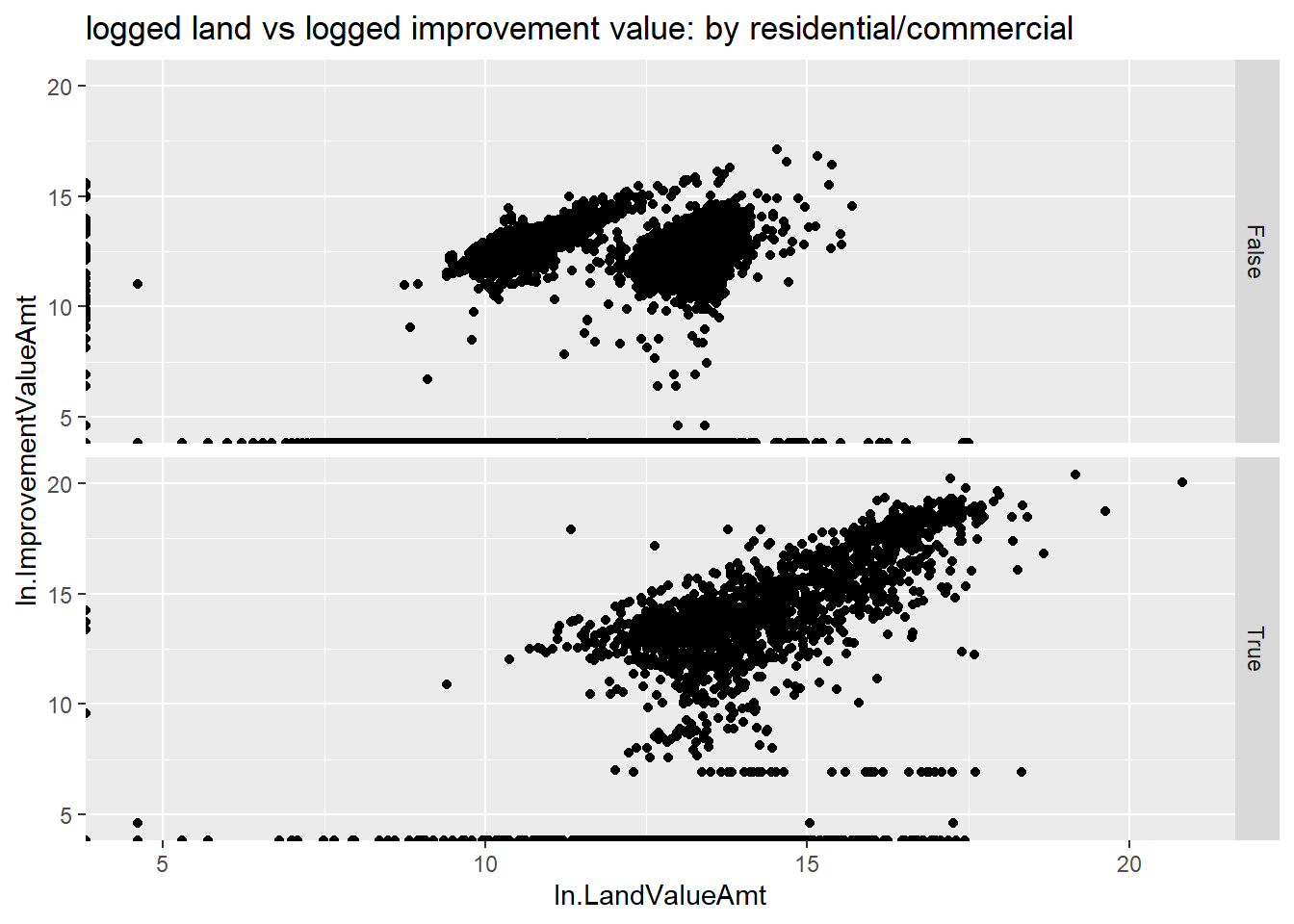

C.3. Small multiples

Another way to call attention to comparisons in a distribution is to use small multiples. Below I use facet_grid() to compare the relationship between land and improvement value for residential and non-residential property (we did something like this in Tutorial 4). Below I make a graph with two rows; you can also make columns, or a grid with multiple rows and columns.

I don’t think this is the best use of small multiples, but this gives you at least a flavor of what they do.

I use the CommercialInd variable, which takes on the values of TRUE and FALSE for this step.

# residential vs commercial

table(arl.p$CommercialInd)

False True

63302 2489 h1 <-

ggplot(data = arl.p,

mapping = aes(x = ln.LandValueAmt, y = ln.ImprovementValueAmt)) +

geom_point() +

facet_grid(rows = vars(CommercialInd)) +

labs(title = "logged land vs logged improvement value: by residential/commercial")

h1

I ask you to think about what these graphs tell us in the homework.

D. A limited scatter: year built and value

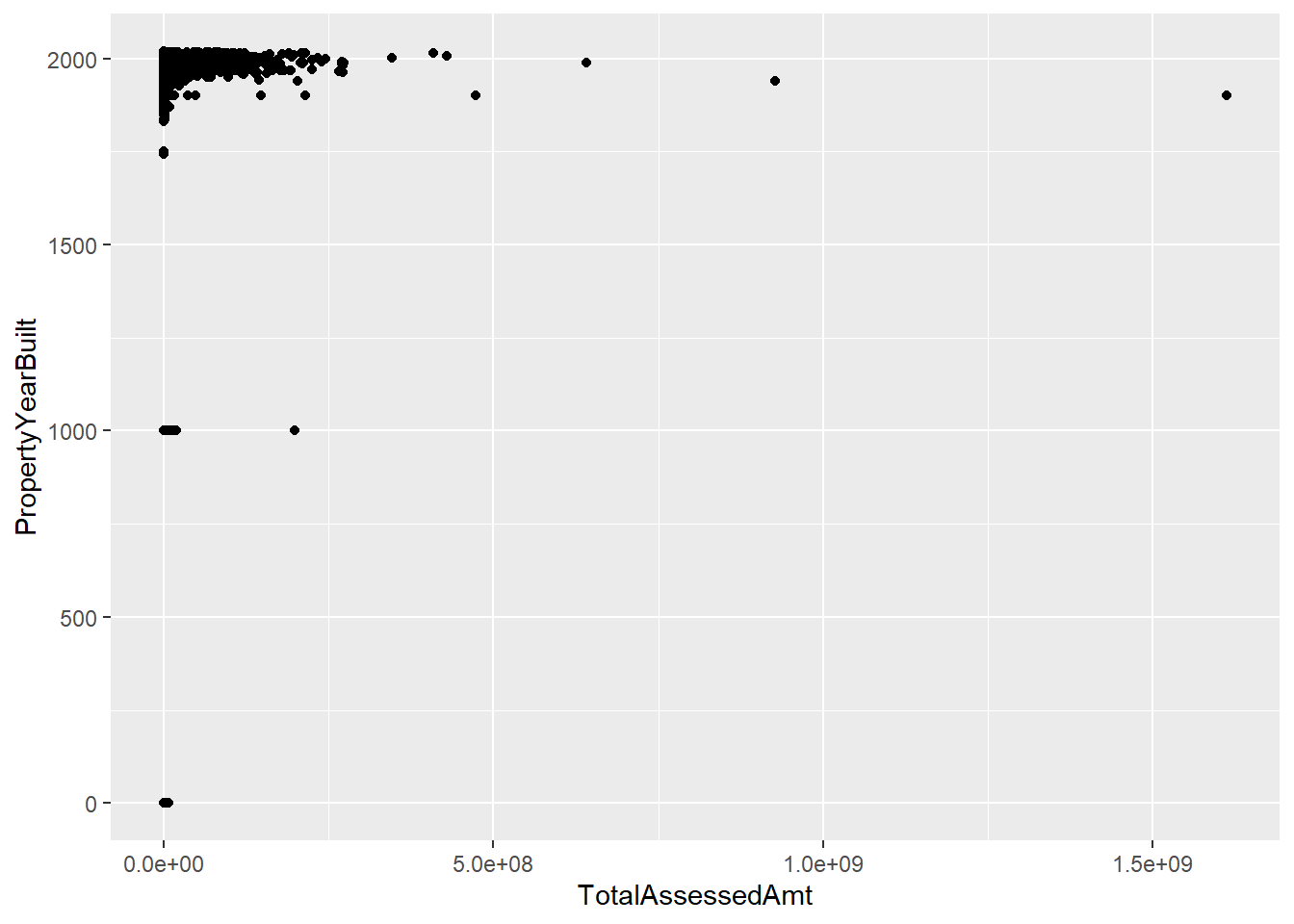

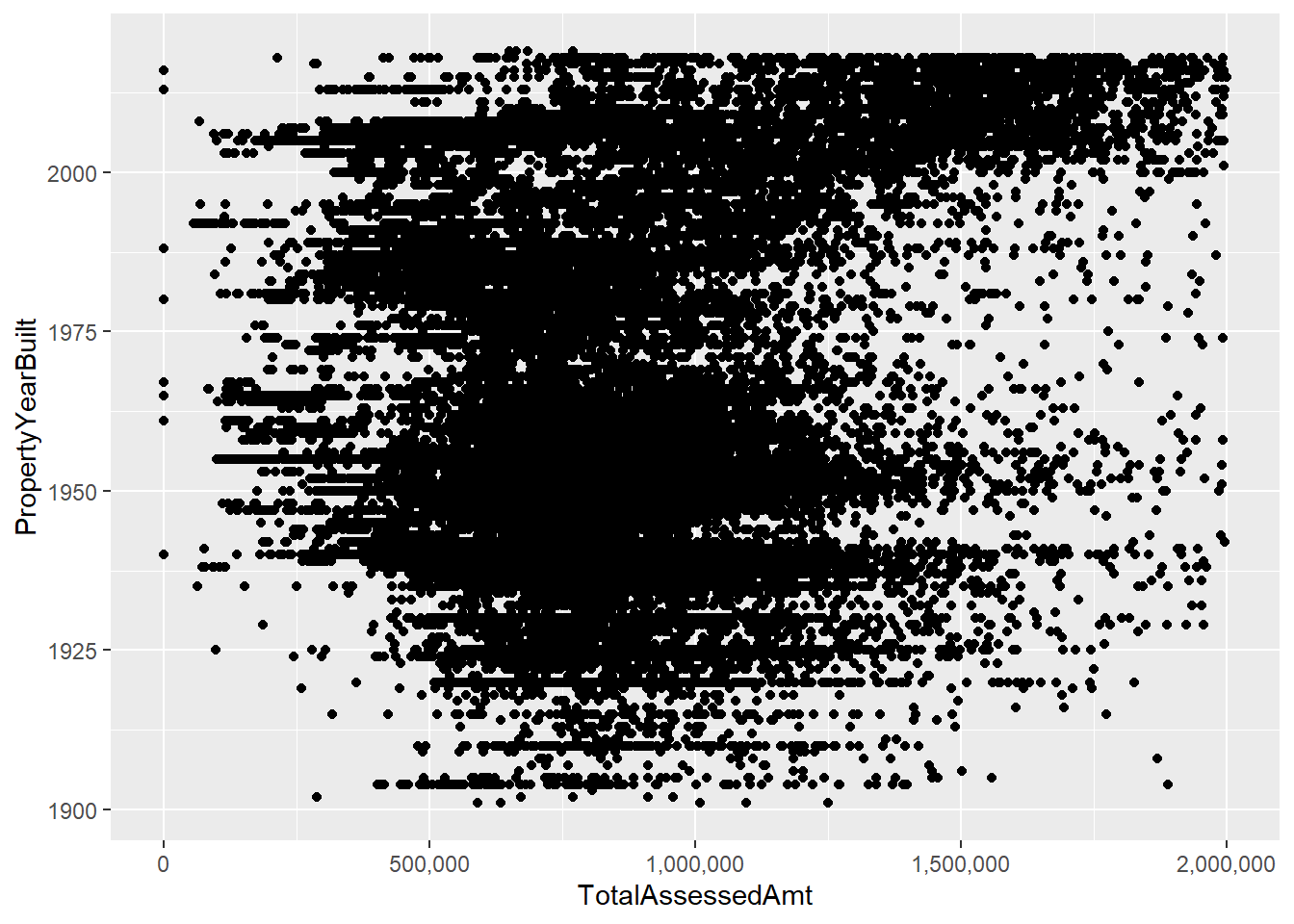

We now edge toward looking at a Cleveland dot plot by considering the relationship between the year a structure was built (PropertyYearBuilt) and its value (TotalAssessedAmt).

This is a ggplot geom_point() as before, but recall that the year takes on discrete (as in an integer), rather than continuous, values.

# distribution of assessed value by year built

c1 <-

ggplot() +

geom_point(data = arl.p,

mapping = aes(x = TotalAssessedAmt, y = PropertyYearBuilt))

c1Warning: Removed 3392 rows containing missing values (geom_point).

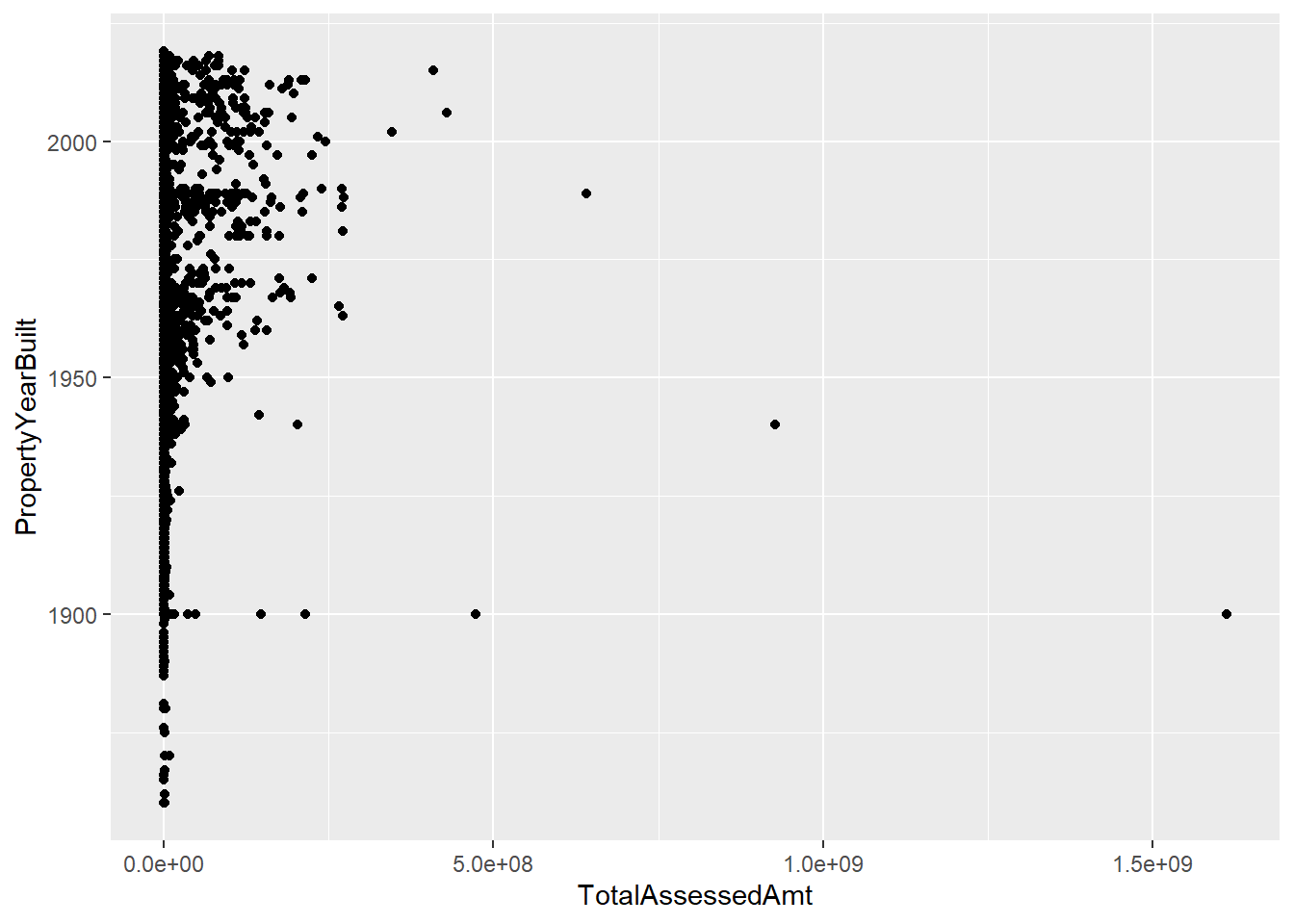

This chart immediately points out some data problems. There are no structures in Arlington from the year 1000. Let’s limit to years 1850 and onward for a better looking chart.

# distribution without some crazy years

c2 <-

ggplot() +

geom_point(data = arl.p[which(arl.p$PropertyYearBuilt >1850),],

mapping = aes(x = TotalAssessedAmt, y = PropertyYearBuilt))

c2

This fix highlights the need to limit the amount of assessed values we consider; for purposes of graphing I set this maximum at 2,000,000, using the limits() option in scale_x_continuous().

# distribution without some crazy assessed values

c4 <-

ggplot() +

geom_point(data = arl.p[which(arl.p$PropertyYearBuilt >1900),],

mapping = aes(x = TotalAssessedAmt, y = PropertyYearBuilt)) +

scale_x_continuous(label=comma, limits=c(min(0),

max(2000000)))

c4Warning: Removed 1312 rows containing missing values (geom_point).

Regardless of these fixes, these charts suffer from having so many dots that it’s hard to understand what’s going on. This is where you need to mix statistics and graphics. We’ll calculate the median assessed value in each year and then limit the plot to this information.

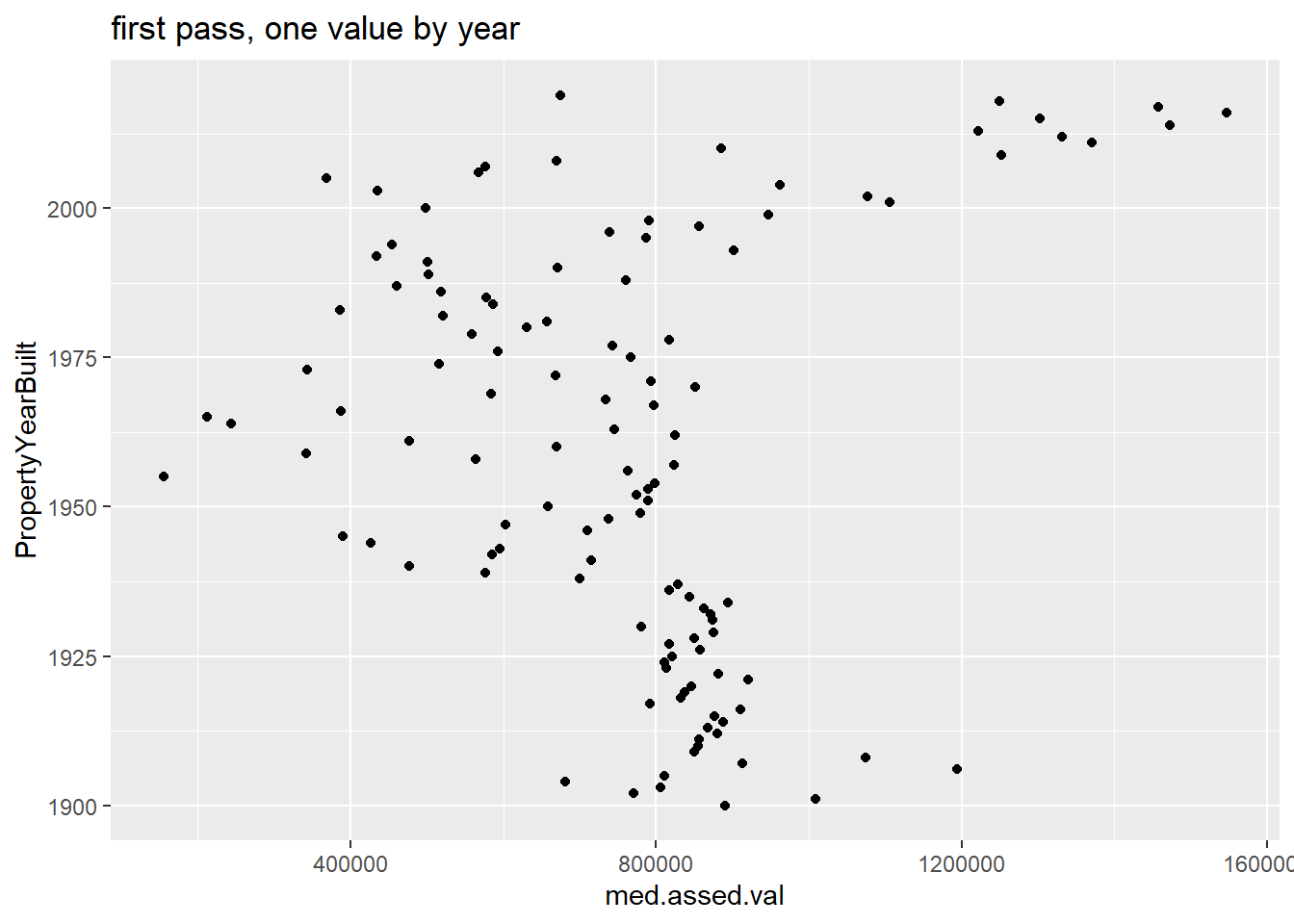

We begin with the combination of group_by() and summarize() that we’ve used before to get a dataframe that has one observation by PropertyYearBuilt.

# find the points

arl.p.byy <- group_by(.data = arl.p, PropertyYearBuilt)

byyear <- summarize(.data = arl.p.byy,

med.assed.val = median(TotalAssessedAmt),

med.imp.val = median(ImprovementValueAmt),

med.land.val = median(LandValueAmt))

head(byyear)# A tibble: 6 × 4

PropertyYearBuilt med.assed.val med.imp.val med.land.val

<int> <dbl> <dbl> <dbl>

1 0 681400 598200 70700

2 1000 437800 263300 352800

3 1742 642800 30800 612000

4 1750 693200 147800 545400

5 1832 958800 327500 631300

6 1836 1122500 199050 923450With these data in hand, we turn to the plot:

# plot them

e1 <-

ggplot() +

geom_point(data = byyear[which(byyear$PropertyYearBuilt >= 1900),],

mapping = aes(x = med.assed.val,

y = PropertyYearBuilt)) +

labs(title = "first pass, one value by year")

e1

This is easier to understand, but doesn’t do a good job highlighting the horizontal distance, which is the key value in this chart. In fact, the default horizontal distance doesn’t even start at 0, which makes the comparison across years misleading.

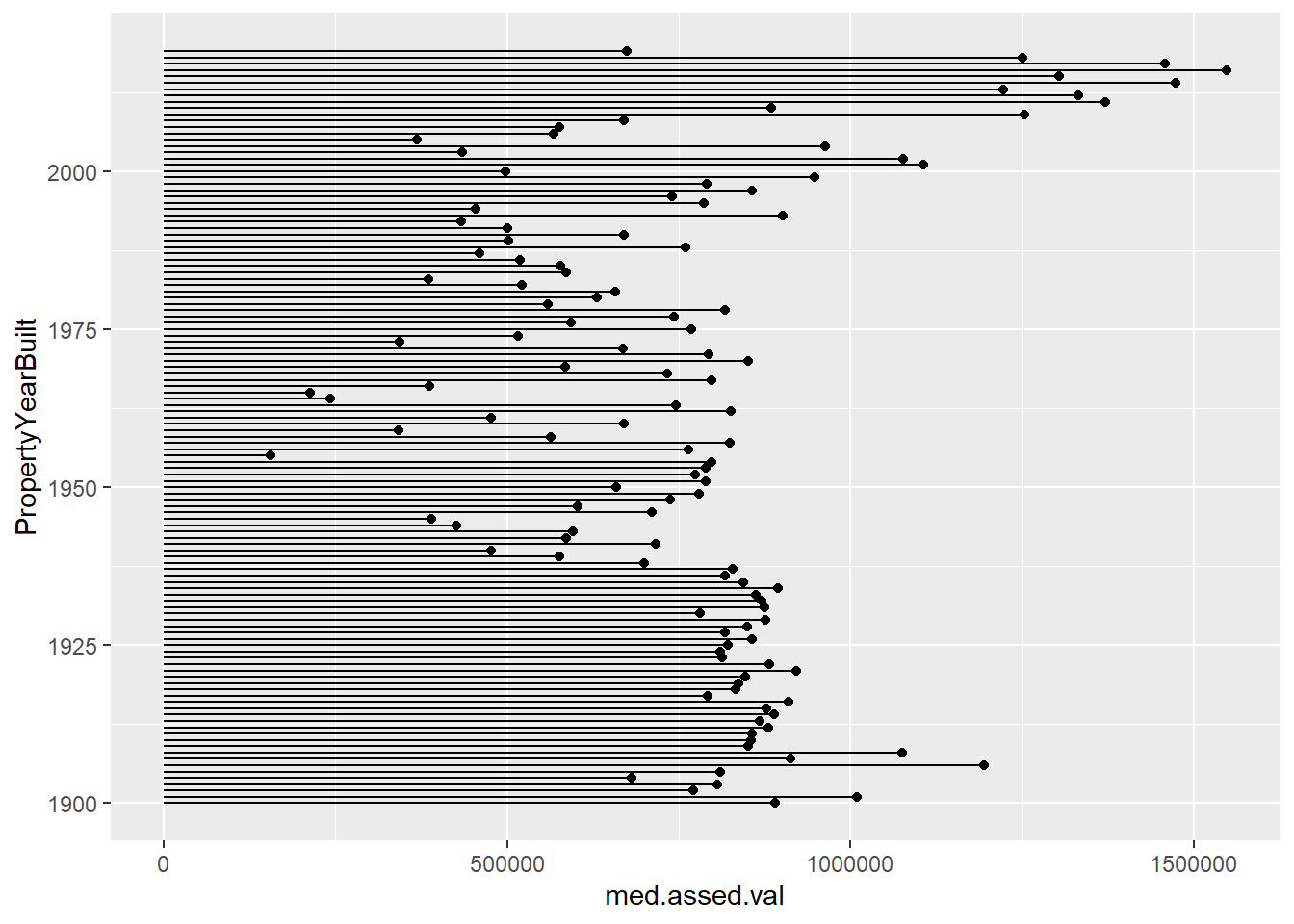

A lollipop graph – a version of the Cleveland dot plot – does a better job. In general, I would recommend this for fewer observations that we have here, though this might look fine in a large format. We also use geom_segment(), which takes xend and yend in addition to x and y. This draws a segment from (x,xend) to (y,yend). In our case, we want a straight line, so y and yend are the same. The segment starts at x=0 and ends at the median assessed value for that year.

# lollipop version

e1 <-

ggplot() +

geom_point(data = byyear[which(byyear$PropertyYearBuilt >= 1900),],

mapping = aes(x = med.assed.val,

y = PropertyYearBuilt)) +

geom_segment(data = byyear[which(byyear$PropertyYearBuilt >= 1900),],

mapping = aes(x = 0, xend = med.assed.val,

y = PropertyYearBuilt, yend = PropertyYearBuilt))

labs(title = "first pass, one value by year")$title

[1] "first pass, one value by year"

attr(,"class")

[1] "labels"e1

E. More Cleveland dot plots

Now we move to a more serious consideration of the power of dot plots, with many thanks to this excellent tutorial.

E.1. Just one point

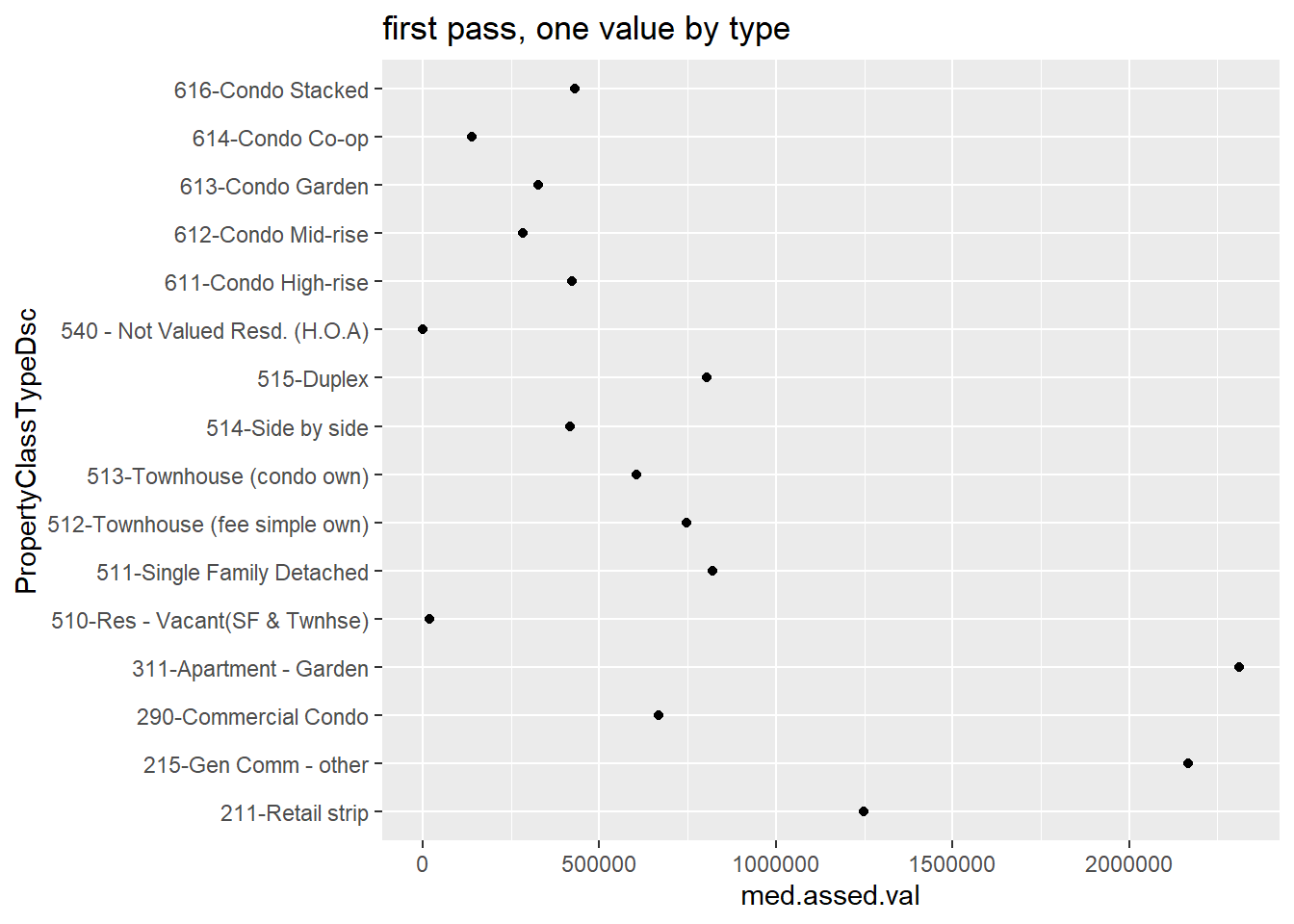

We need a smaller set of categories to make a reasonable looking chart, so we will look at the PropertyClassTypeDsc variable (words for the PropertyClassTypeCode variable) and limit our analysis to codes with more than 200 properties. These codes describe the type of property – single family, townhome, commercial, etc.

We start by finding the median assessed value by property class using group_by() and summarize().

# find the points

arl.p.bypc <- group_by(.data = arl.p, PropertyClassTypeDsc)

bypc <- summarize(.data = arl.p.bypc,

med.assed.val = median(TotalAssessedAmt),

med.imp.val = median(ImprovementValueAmt),

med.land.val = median(LandValueAmt),

obs = n())If you look at the bypc dataframe, you’ll see that there are many property types with few observations (small obs). For legibility – and to concentrate on the bulk of the distribution, we graph types with more than 200 properties. We use geom_point() as a starting point.

# plot them if there are > 200 obs

e1 <-

ggplot() +

geom_point(data = bypc[which(bypc$obs > 200),],

mapping = aes(x = med.assed.val,

y = PropertyClassTypeDsc)) +

labs(title = "first pass, one value by type")

e1

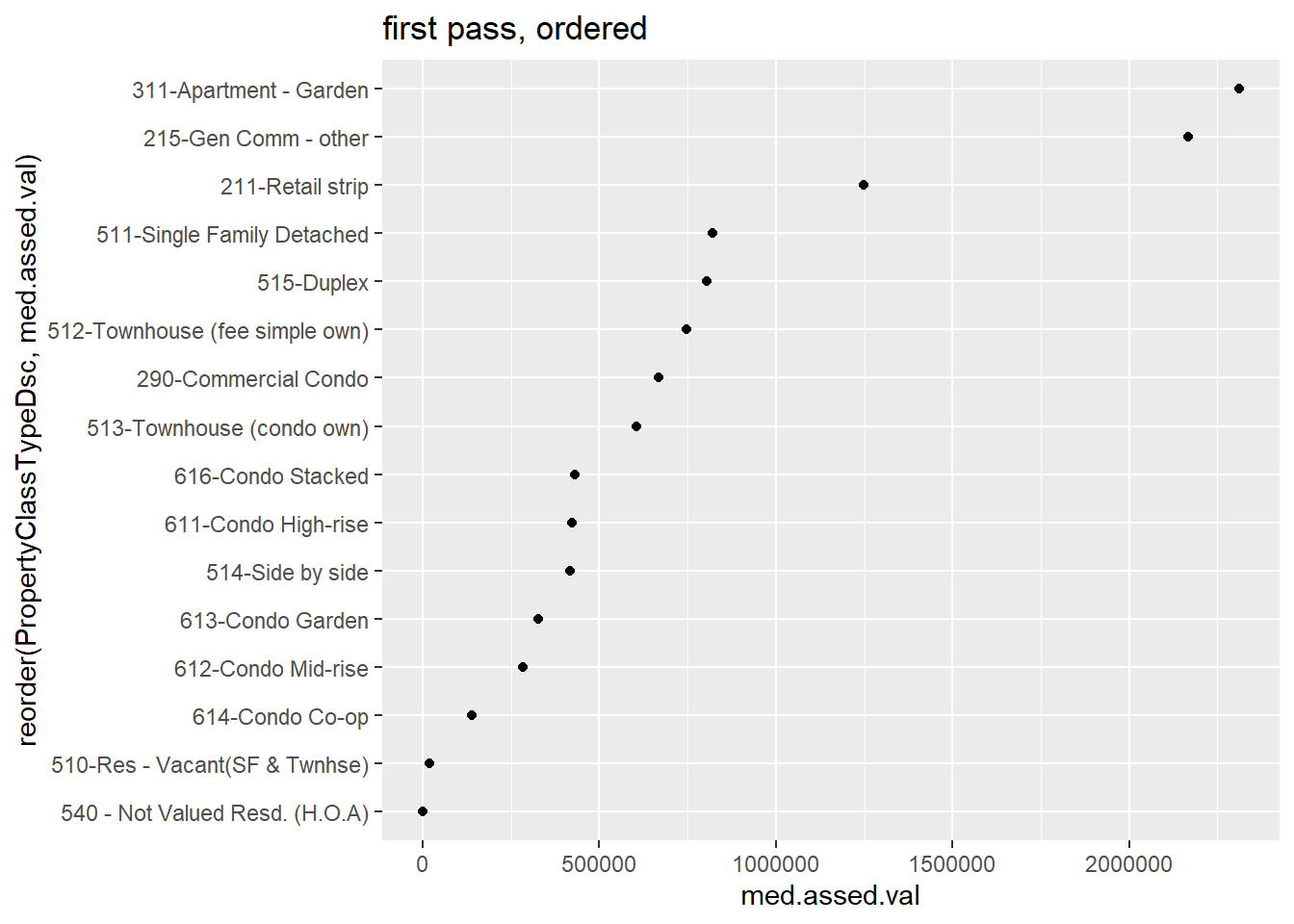

This is not very helpful because the points are not in order. We can order points many ways; here I use reorder() when I call the y variable. The syntax for this command is reorder(graph variable, ordering variable).

# lets get them in order!

e1 <-

ggplot() +

geom_point(data = bypc[which(bypc$obs > 200),],

mapping = aes(x = med.assed.val,

y = reorder(PropertyClassTypeDsc, med.assed.val))) +

labs(title = "first pass, ordered")

e1

E.2. Two points

The real power of this dot plot is in making comparisons between two measures, as in the Wall Street Journal graphic we discussed in class. However, we’ve just calculated one statistic for each property type; to revise the chart, we’ll need to calculate more than one. Below I use the quantile() command to find the 25th and 75th percentiles of the assessed value distribution by year. This command has at least two required parts: the variable from which to find the distribution, and the point in the distribution for which you’re looking.

# let find the 25th and 75th percentiles

# two points

arl.p.bypc <- group_by(.data = arl.p, PropertyClassTypeDsc)

bypc <- summarize(.data = arl.p.bypc,

p50.assed.val = median(TotalAssessedAmt, na.rm = TRUE),

p25.assed.val = quantile(TotalAssessedAmt, 0.25, na.rm = TRUE),

p75.assed.val = quantile(TotalAssessedAmt, 0.75, na.rm = TRUE),

obs = n())To use the best of R’s tricks for graphing, we need to make these data long. As we have in previous tutorials, we’ll use pivot_longer() to do this. Look in the previous tutorials for a more in-depth explanation of this command, or see the cheat sheet here.

# keep in mind that -obs- now refers to the # of the entire category

bypc.long <- pivot_longer(data = bypc,

cols = c("p50.assed.val","p25.assed.val","p75.assed.val"),

names_to = "stat.name",

values_to = "stat.value")

# pull out the statistic

bypc.long$pnum <- substring(bypc.long$stat.name,2,3)

head(bypc.long)# A tibble: 6 × 5

PropertyClassTypeDsc obs stat.name stat.value pnum

<chr> <int> <chr> <dbl> <chr>

1 100-Off Bldg-VacLand-no s.plan 10 p50.assed.val 722100 50

2 100-Off Bldg-VacLand-no s.plan 10 p25.assed.val 122375 25

3 100-Off Bldg-VacLand-no s.plan 10 p75.assed.val 1046050 75

4 101-Off Bldg-VacLand-site plan 56 p50.assed.val 1943300 50

5 101-Off Bldg-VacLand-site plan 56 p25.assed.val 272125 25

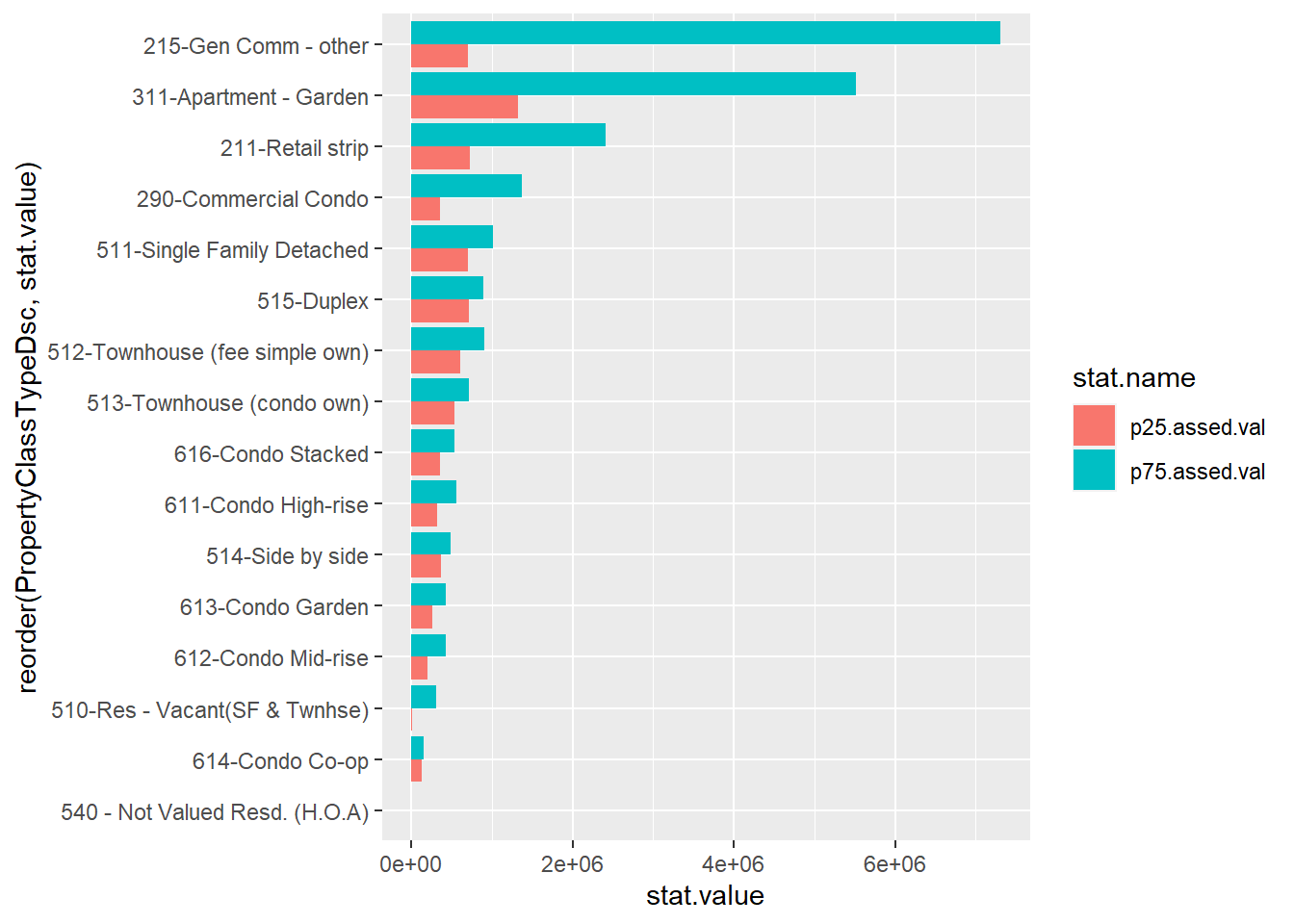

6 101-Off Bldg-VacLand-site plan 56 p75.assed.val 6073950 75 One way we’ve used to make comparisons across a pair at multiple levels or categories is a paired or grouped bar. Let’s start with that for comparison. Recall that we use geom_col for a bar graph where we’ve already calculated the required statistics. We use position = "dodge" to make paired bars. The aes() option fill = is for our statistic type. We limit the sample to property types with more than 200 properties and to the 75th and 25th percentiles (no median, so bypc.long$pnum != "50").

# use the comparison to bar charts

badbar <-

ggplot() +

geom_col(data = bypc.long[which(bypc.long$pnum != "50" & bypc.long$obs > 200),],

mapping = aes(x = reorder(PropertyClassTypeDsc, stat.value),

y = stat.value, fill = stat.name),

position = "dodge") +

coord_flip()

badbar

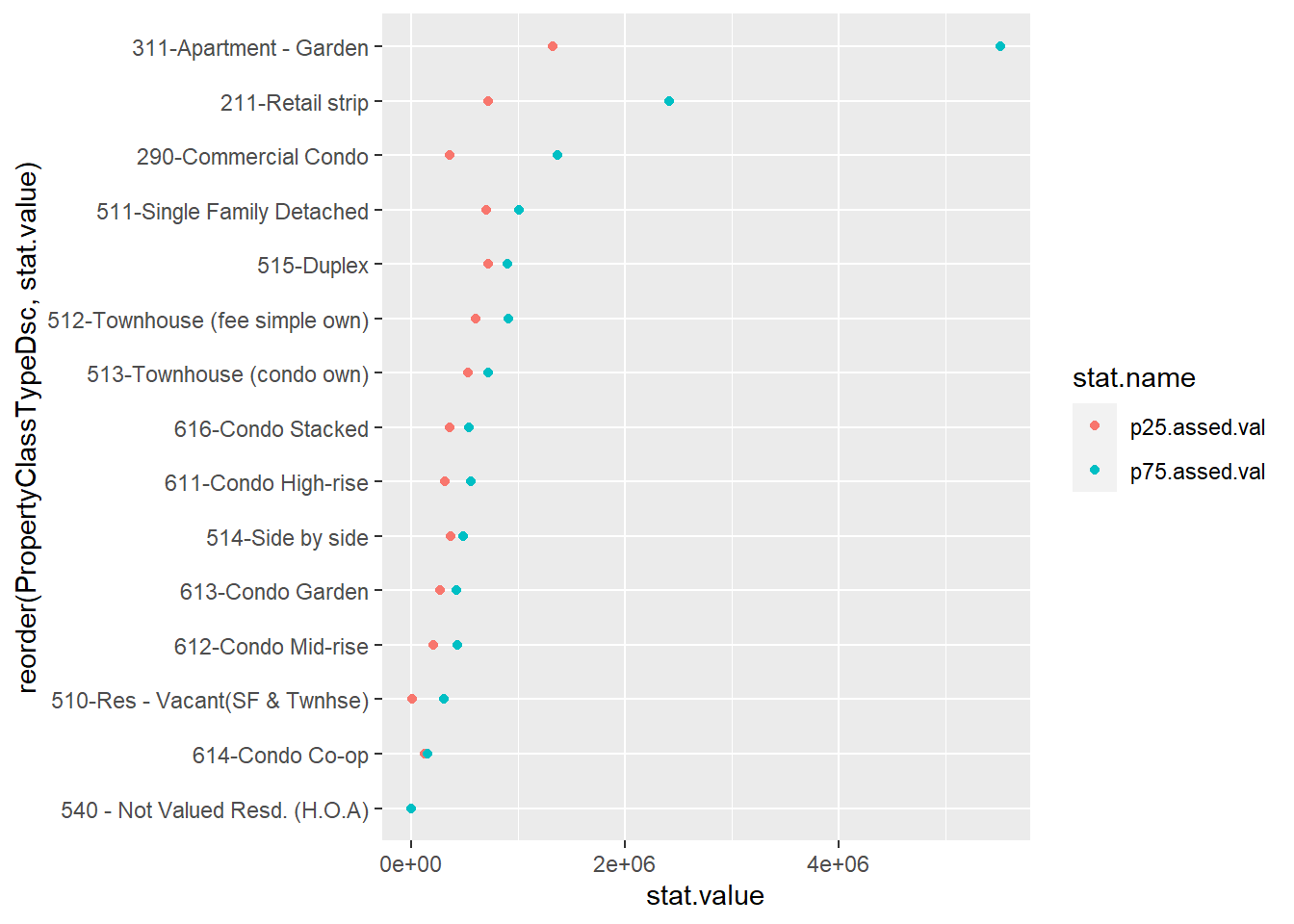

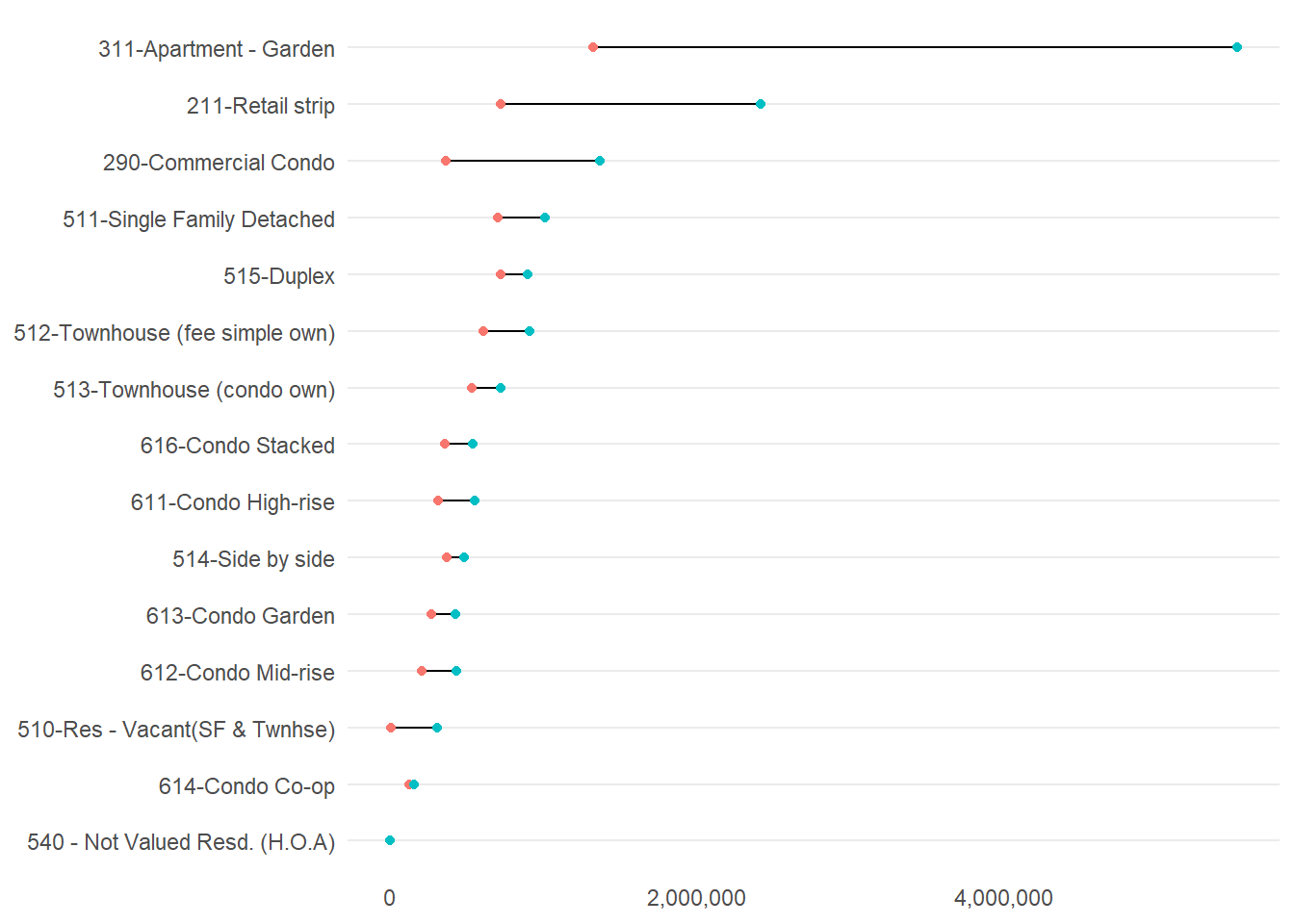

This picture is not a disaster – but it’s cluttered and doesn’t always make the best visual comparison between the relevant two bar lengths. Instead, let’s use a dot plot. We’ll start by just plotting both the 25th and 75th percentiles (and omitting the category “215”, which is commercial buildings, which has a high 75th percentile and makes the graph look odd).

# two colors

twoc <-

ggplot() +

geom_point(data = bypc.long[which(bypc.long$pnum != "50"

& bypc.long$obs > 200

& bypc.long$PropertyClassTypeDsc != "215-Gen Comm - other"),],

aes(x = stat.value, y = reorder(PropertyClassTypeDsc, stat.value), color = stat.name))

twoc

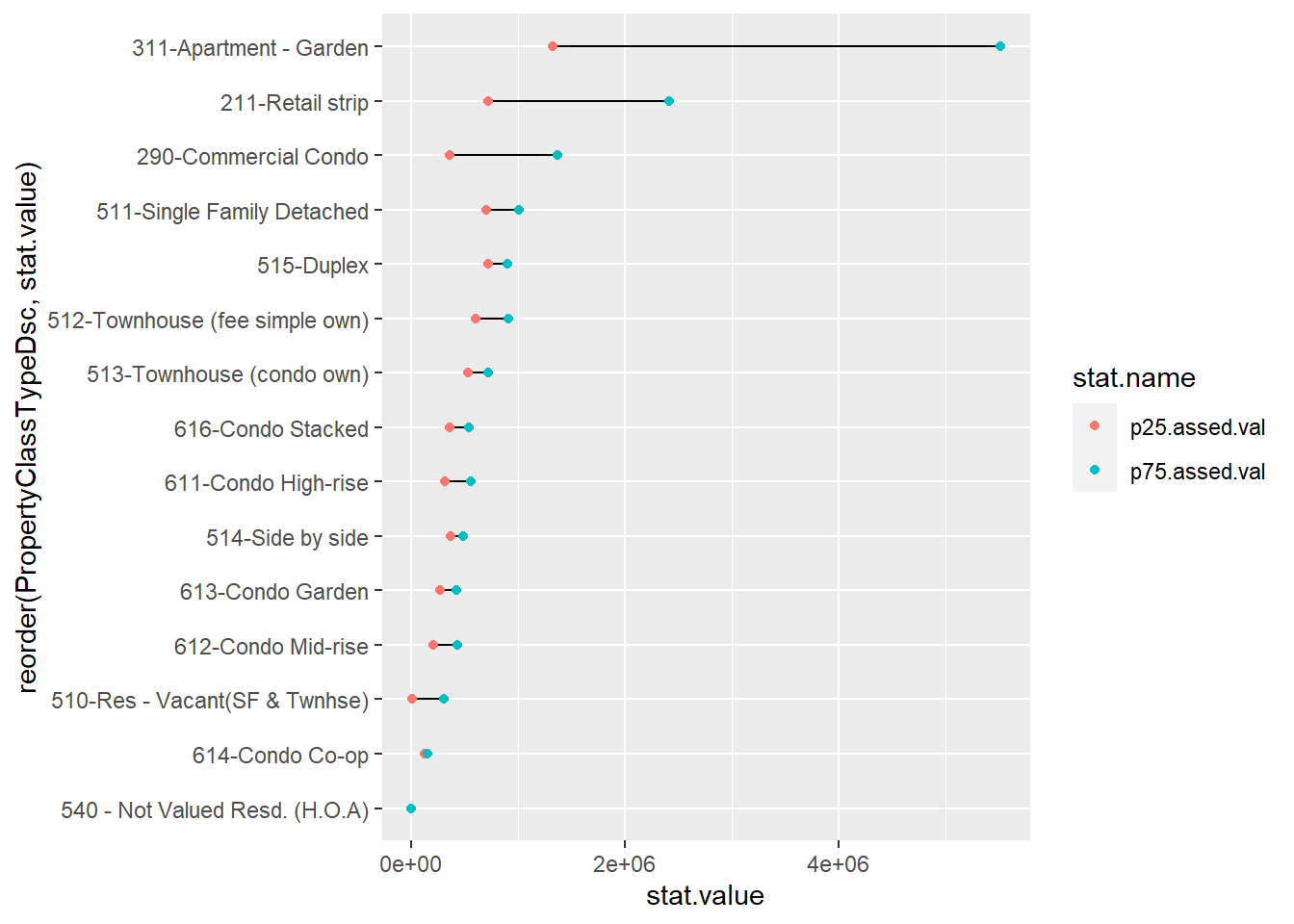

Now let’s do some fixes to make this more clear. We’ll add a line to emphasize the horizontal comparison we want readers to make, and we put all the data info into the ggplot() call since it is the same for both the geom_point() and the geom_line() commands. The geom_line() command uses aes(group = PropertyClassTypeDsc) to let R know that the line should be by the y variable. We put the geom_line() before geom_point() so that the points cover the line and it looks neater.

# two colors, make it look decent

twoc <-

ggplot(data = bypc.long[which(bypc.long$pnum != "50"

& bypc.long$obs > 200

& bypc.long$PropertyClassTypeDsc != "215-Gen Comm - other"),],

mapping = aes(x = stat.value,

y = reorder(PropertyClassTypeDsc, stat.value))) +

geom_line(aes(group = PropertyClassTypeDsc)) +

geom_point(aes(color = stat.name))

twoc

This graph has all the basics. Let’s do a little more clean-up on the overall look by getting commas in the scales and fixing the background with the theme() command.

## make it presentable

twocd <-

ggplot(data = bypc.long[which(bypc.long$pnum != "50"

& bypc.long$obs > 200

& bypc.long$PropertyClassTypeDsc != "215-Gen Comm - other"),],

aes(x = stat.value, y = reorder(PropertyClassTypeDsc, stat.value))) +

geom_line(aes(group = PropertyClassTypeDsc)) +

geom_point(aes(color = stat.name)) +

scale_x_continuous(label=comma) +

labs(y = "structure assessed value") +

theme_minimal() +

theme(axis.title = element_blank(),

panel.grid.major.x = element_blank(),

panel.grid.minor = element_blank(),

legend.position = "none",

plot.title = element_text(size = 20, margin = margin(b = 10)))

twocd

We could still do some fixes here. One key fix is labeling the 75th and 25th percentiles somewhere on the graph.

Some other concerns: Why these two colors? I think two shades of the same color might be more intuitive. I’d make the joining line less dark and distracting. I’d also look into the suspiciously high 75th percentile value (higher than for single family homes!) for garden apartments.

F. Homework

1

Use a density plot to evaluate whether residential or commercial structures have a greater variance in assessed value. To do this, I encourage you to use the facet_grid() we learned this class in combination with geom_density(). To discriminate between residential and commercial structures, use arl.p$CommercialInd.

2

Re-do the graph in section D that plots the average, the 25th percentile, and the 75th percentile of value by year built. Rather than plotting each year, plot each ten year period from 1900 to 2010. You can do this by taking an average for each decade, or by just taking the beginning or end of each decade. Add a legend for the 25th and 75th percentiles by color.

In case this seems overwhelming, here is the order of operations I followed:

- group the data

- summarize to the year level

- keep only decade years

- alternatively, create a decade variable and summarize by that

- keep only years >= 1900

- make the dataframe long

- plot it

3

Make a nice-looking scatter from a different dataset.

This is our ninth tutorial, posted for Lecture 10.↩︎